about company

A regional bank providing personal and commercial banking services for over 50 years in African subcontinent.

Reviewed on

☆☆☆☆☆ 5/5

31 Reviews

12

+

Physical Bank Branches

8

>

week development cycle, achieved full digitalization.

83000

+

concurrent users, ensuring scalability during peak hours.

The Chalange

The bank faced challenges in meeting the digital expectations of its customers, including slow transaction processing, lack of mobile banking features, and inadequate data security measures. The primary issues included:

- Outdated banking systems causing delays and inefficiencies.

- Lack of a user-friendly mobile banking app.

- Security concerns with online transactions.

What did

Quinite do

Quinite Technologies undertook a comprehensive digital transformation initiative that included:

- System Overhaul: Upgraded the bank’s core banking system to a modern, cloud-based platform that improved transaction speed and reliability.

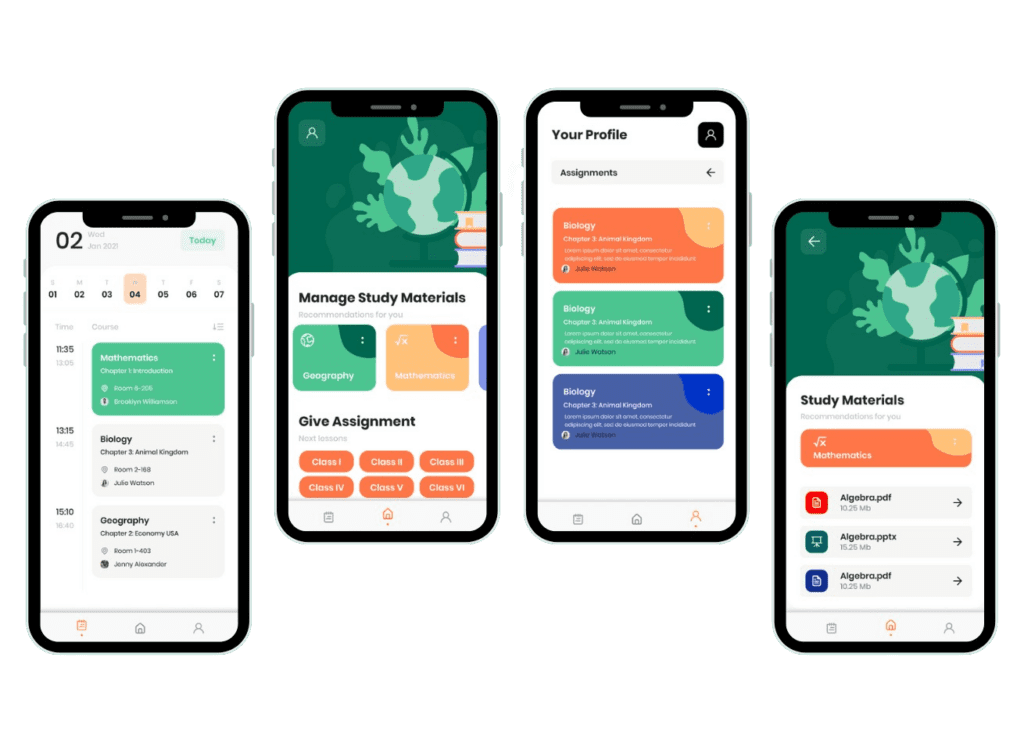

- Mobile Banking: Developed a user-friendly mobile banking app with features such as instant transfers, bill payments, and account management.

- Enhanced Security: Implemented advanced security protocols, including multi-factor authentication and real-time fraud detection, to safeguard customer data.

- Data Analytics: Leveraged data analytics to provide personalized financial advice and products to customers based on their transaction history and financial goals.

- Customer Support: Enhanced customer support with AI-powered chatbots and 24/7 service availability.

The Results

- User Engagement: High adoption rate of the mobile banking app and increased customer satisfaction.

- Security: Enhanced security measures resulting in fewer fraud incidents.

- Personalized Services: Increased customer satisfaction through personalized financial advice and products.

Partners and technologies helping us shape the future of banking

Salesforce

AWS

Cisco

Mambu

UiPath

Mulesoft

FICO Falcon

React Native